|

The Innovation Center for Energy and Transportation (iCET)

June 2017

In April, Ministry of Industry and Information Technology (MIIT), National Development and Research Commission (NDRC) and Ministry of Science and Technology (MOST) jointly issued the "Long-Term Development Plan for the Automobile Industry," reaffirming the importance of technological advancement for improving energy efficiency. During the 12th Five Year Plan (FYP), the development of new energy vehicles played an important role, as was demonstrated by economic policies (e.g. subsidies and research grants) and regulatory policies (manufacturing requirements). Yet energy efficient vehicles technologies did not keep a similar pace, perhaps partially because of the relatively non-stringent vehicle fuel consumption (FC) requirements.

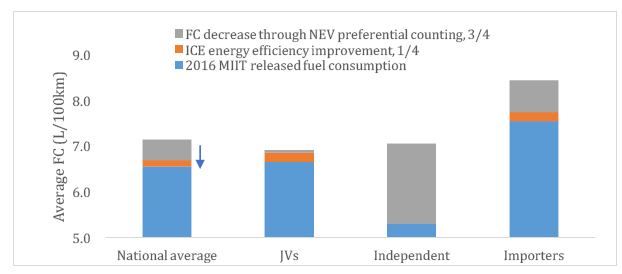

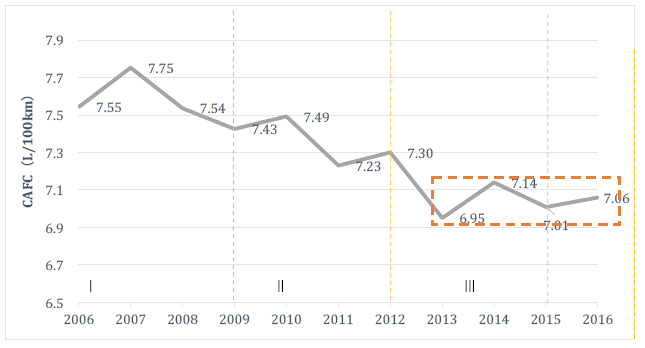

According to the MIIT, 2016 Corporate Average Fuel Consumption (CAFC) memo released on April 2017 , China’s market reached an average of 6.56L/100km, comprised of domestic manufacturers with 6.51L/100km and imported with an average CAFC of 7.89L/100km. In comparison to last year’s average of 7.04L/100km, this is a drop of 7% in corporate average fuel efficiency. Also against the 2016 target of 6.7L/100km, China’s corporate auto players performed well. However, a more thorough investigation reveals issues surrounding the actual energy efficient technology improvements of China’s huge ICE vehicle fleet.

1. NEV preferential counting overrides ICE vehicles’ energy efficiency improvements

In 2016, China entered Phase IV of its CAFC regime, a regime that counts each New Energy Vehicle (NEV) produced as five cars with 0 FC. Should this new counting method be removed and Phase III calculation be used, China’s CAFC would have declined by only 1.7%, far below the 7% calculated according to MIIT’s data. It is NEV production that reduced CAFC by some 5% and not the result of actual fuel efficiency improvements.

2. Many companies failed to meet the annual target, possibly because of lack of enforcement mechanism

Since the implementation of Phase III of China’s fuel consumption standard regime the volume of corporations meeting the standard has increased, yet this trend has been challenged in 2016 as Phase IV entered force. Evidentially, the technological capacity required for meeting the standard that increased in stringency is not something most manufacturers seem to be ready for. About one-third of domestic manufacturers didn't meet their CAFC requirement, while as many as half of importing corporations failed to meet their CAFC requirement. A clear management mechanism over Phase IV has yet to be introduced, and it is likely this less effective approach will be maintained while NEV flexibility mechanism will decrease corporate motivation for ICE vehicles technological upgrades.

3. Given the weighting of China’s fleet, FC reduction challenges increase

While vehicle sales increase by 4%, SUVs and MPVs sales maintained growth rates over 40% and 20% respectively for four consecutive years. This, comprised half of China’s light duty vehicle sales. In 2016, the average fuel consumption of SUVs was 1.2L/100 km higher than that of the average car. The average weight of SUVs 200kg more than that of the average car. Over the past four years China’s average fleet weight increased by 140 kg, posing great challenges for FC standard adherence.

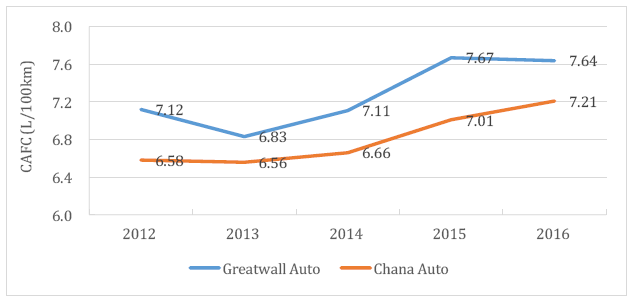

The average fuel consumption of independent domestic manufacturers brands has not improved since 2013, and even saw a slight rebound. Apart from the increase in NEV production volumes, the main reason for this seems to be the steady increase in average fleet weight and larger class models. For example, MY2016 average fleet weight saw an increase of 57kg from last year, suppressing the weight increase of 2014 and 2015 combined. China's two best-selling independent manufacturers of 2016 (sold nearly one million vehicles combined), Great Wall Motor and Chana Automobile, didn't comply with the standard. Moreover, over the past four year their CAFC continuously rose, likely due to the steady increase in large-size vehicle, primarily SUVs and MPVs.

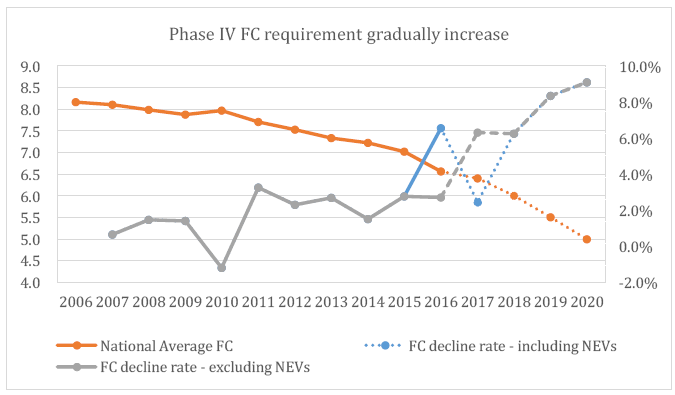

4. The difficulty in meeting China’s CAFC will increase, and reliance on NEV production may no longer suffice.

According to Phase IV of China’s national fuel consumption standards, between 2019 and 2020 the annual average CAFC decline would be 8%-9%. Although NEV production has been instrumental in meeting the standard thus far, it may not be sufficient going forward as the counting method decreasing NEV impact on CAFC and as CAFC standard is aimed at 4L/100km by 2025. The time to place more emphasis on energy efficiency technology development for China’s ICE fleet is now.

5. CAFC management should be decided and should include economic instrumentation, push and pull mechanism.

China started to implement the average fuel consumption (CAFC) management mechanism in 2012 and discussed the establishment of CAFC credits trading and accumulation since 2013 for encouraging the standard’s sound implementation. In 2014, the Strengthening the Management of Average Fuel Consumption of Passenger Car Enterprises was announced, strengthening the standard’s management by authorizing the suspension of product. The overall fuel consumption requirements part of Phase III were arguably not very strict, and given the lack of effective enforcement motivators - resulted in the postponing of meaningful technological upgrades.

Although Phase IV entered implementation a year and a half ago, its management policy is still uncertain. Moreover, last September a novel NEV credits mechanism draft was released, meant to be joint with the CAFC credits - that has soon to be proven effective and manageable. This new management approach is likely to further intensify the adverse effect of China’s NEV flexibility on the ICE fleet FC.

|